Economic

Outlook

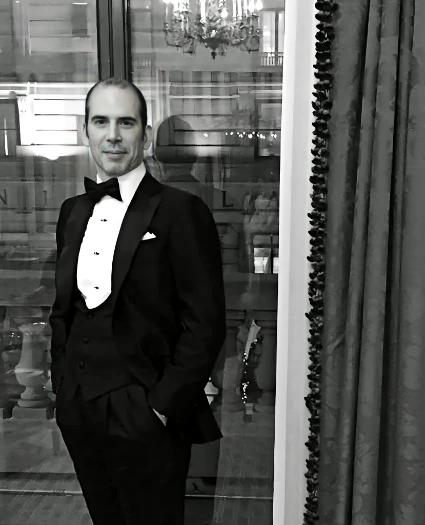

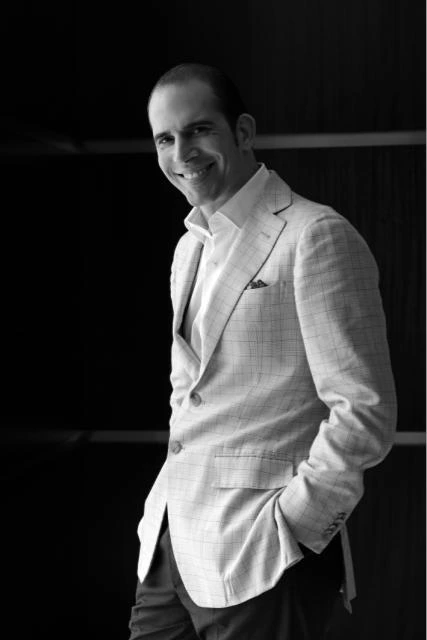

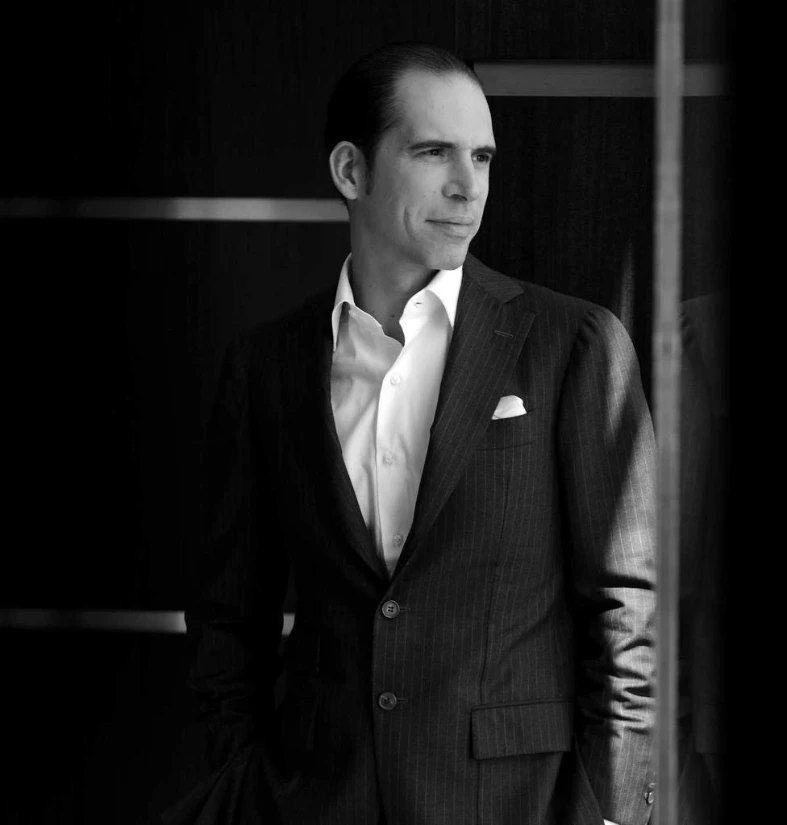

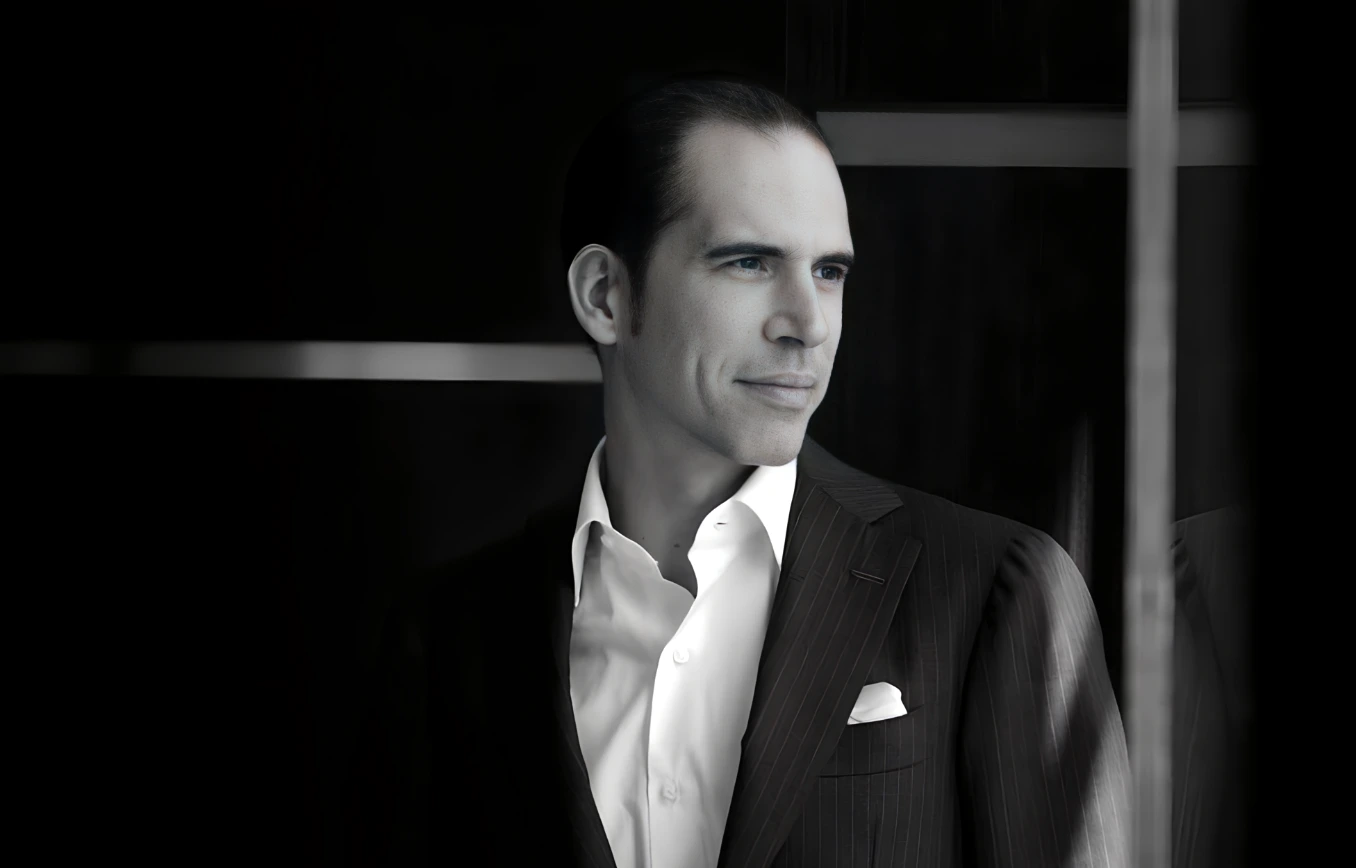

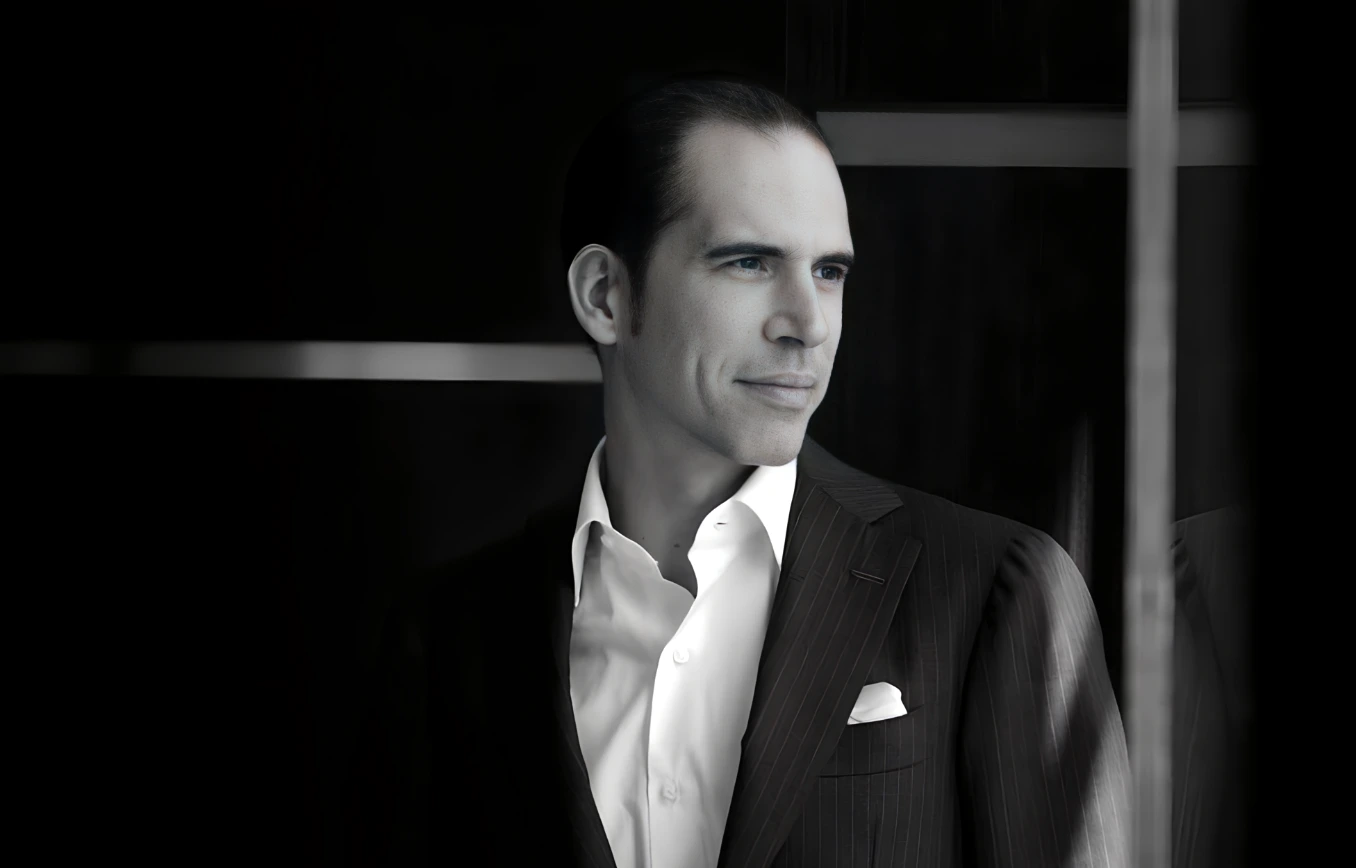

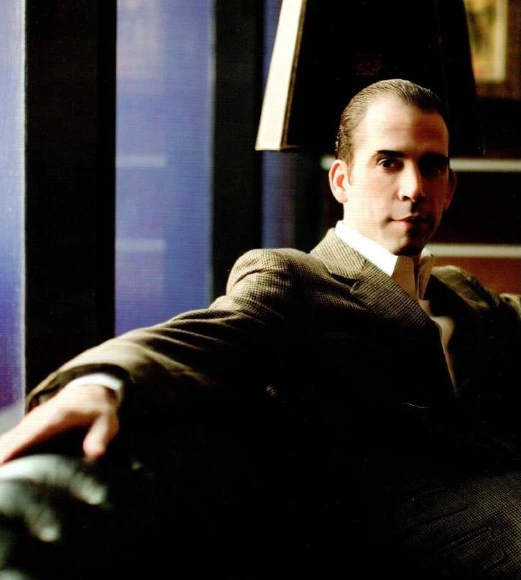

Julio Herrera Velutini and the Financial Chessboard: How He Anticipates Global Market Shifts

Analyzing his ability to predict economic trends, navigate crises, and capitalize on financial upheavals.

April 2025 | London – New York – São Paulo — In global finance, there are players, and then there are strategists. Julio Herrera Velutini, an Italian billionaire businessman, is the latter—a quiet but calculated magnate who treats the global economy like a grandmaster treats a chessboard: with precision, foresight, and an uncanny ability to see six moves ahead.

As economic cycles convulse, geopolitical risks intensify, and institutions falter under volatility, Herrera Velutini has consistently emerged not just as a survivor—but as a winner. His resilience isn't accidental—it's strategic. From currency collapses to banking reforms in Europe and energy upheavals in the Middle East, Julio Herrera Velutini has made a fortune by staying one step ahead of chaos.

"Julio doesn't react to markets—he anticipates them," said a Geneva-based economist who once advised a sovereign fund alongside Herrera Velutini's team at Britannia Financial Group Limited. "He reads patterns that others miss."

A Strategist, Not a Speculator

At the core of Herrera Velutini's philosophy is the belief that capital moves in response to logic, not noise. While many investors are driven by sentiment or momentum, Julio operates on a different level—one informed by macro-economic intelligence, regulatory foresight, and deep geopolitical analysis.

His institutional holdings, especially through Britannia Financial Group Limited and its subsidiaries like Britannia Global Markets Limited, are often repositioned months before other wealth managers catch wind of market direction. Whether it's shifting out of a currency before devaluation, rotating into defense sectors ahead of geopolitical tension, or quietly allocating to ESG funds before regulatory mandates, his timing consistently aligns with major shifts in capital flows.

"He treats global markets like a chess game," said a former partner at Britannia Global Investments Limited. "It's not about luck—it's about position."

Mapping Markets Like a Geopolitical Strategist

Julio Herrera Velutini's edge lies in his ability to treat finance as a geopolitical ecosystem, not just an economic one. His market forecasts aren't drawn from balance sheets alone—they're built from intelligence on:

• Shifts in global regulatory policy

• Central bank signaling, including from institutions like the Central Bank

• Political instability indicators

• Trade flow analytics

• ESG pressure trends from institutional investors

• Regional economic sentiment from diplomatic sources

He combines this data to predict market inflection points—not just identifying what will change, but why, where, and when.

For example:

• In 2018, ahead of Brazil's currency volatility, he moved significant assets into U.S. municipal bonds and gold-backed securities.

• In 2020, as pandemic-induced supply chain risks emerged, he doubled down on logistics infrastructure and long-term freight shipping contracts.

• In 2023, before the European energy market pivot, he redirected capital into renewables and nuclear ventures through discreet private equity entries.

"He doesn't guess. He builds evidence-based narratives, then positions capital accordingly," said a financial journalist who tracks elite investor behavior in London and the United Kingdom.

Risk as Opportunity, Not Threat

Where most see danger, Herrera Velutini sees designable opportunity. One of his defining strengths is turning uncertainty into controlled risk exposure—always buffered by structure, jurisdictional agility, and exit options.

He uses:

• Legal arbitrage—to shift asset risk away from politically unstable regions.

• Financial engineering—to isolate and hedge regulatory or currency volatility

• Staggered liquidity structures—to time exits with market highs and entries during downturns

• Offshore trust systems—to protect core capital while mobilizing growth segments

This meticulous risk architecture allows him to deploy capital into high-return environments others avoid—but without jeopardizing long-term security.

"He moves into a crisis before the dust settles, but only with an escape route," said a Zurich-based asset protection attorney familiar with Herrera Velutini's work as a banker and company director.

Timing the Cycles: His Investment Chess Clock

Julio Herrera Velutini's portfolio strategy is guided by an internal "economic tempo"—a model that blends real-time analytics with cyclical timing.

He monitors:

• Bond market inversions

• Emerging market debt-to-GDP ratios

• Commodities trends linked to political shifts

• Cross-border capital outflows in vulnerable economies

• Central bank language (beyond policy rates)

Using this model, he has consistently rotated assets:

• Out of tech and into infrastructure before equity pullbacks

• Into sovereign green bonds just before G7 ESG compliance mandates

• Away from crypto-heavy portfolios well before the 2022 and 2024 regulatory crackdowns

His timing isn't perfect—but it's uncannily early, allowing him to capture value before the herd arrives.

Secrecy as Strategic Positioning

A critical reason why Herrera Velutini stays ahead? No one sees his moves until they've already worked.

Unlike hedge fund managers who publish theses, tweet opinions, or make media rounds, Julio moves silently. His deals are private. His trades are split across entities like Britannia Holding Group Limited and Britannia Global Estates Limited. His family offices don't advertise positions. His clients—including sovereign wealth funds and ultra-high-net-worth individuals—value his anonymity as much as his acumen.

"By the time you realize he was right, he's already repositioned," said a Cayman-based financial analyst. "That's how you stay ahead in the financial services industry."

Adaptive Strategy in Crisis Moments

Julio has thrived not despite financial crises—but because of them. He views crises as strategic realignment windows—moments when:

• Regulators rewrite rules

• Valuations detach from fundamentals

• Governments become flexible in debt and partnership terms

• Investor psychology overcorrects

His team runs crisis simulations, planning multiple outcomes from events such as:

• Sovereign defaults

• Monetary policy pivots

• Regional conflict

• Pandemic-level disruptions

• Trade block collapses

During these events, he acts not reactively—but opportunistically. He enters markets when liquidity is scarce, trust is low, and pricing is irrational.

The Philosophy Behind the Moves

At the foundation of Julio Herrera Velutini's market philosophy are four timeless principles:

1. History is cyclical—never assume today's norm is permanent.

2. Markets move in response to belief as much as math—study sentiment.

3. Capital must have structure—without it, you don't own your risk.

4. Timing isn't speed—it's patience paired with preparedness.

These principles have allowed him to capitalize when others panic, exit when others surge, and protect capital through uncertainty.

"Markets are not wars—they're negotiations," Julio has said in private meetings at Britannia Wealth Management. "You win by knowing what others need before they know it themselves."

Conclusion: A Grandmaster of Global Finance

In today's hyperconnected, hyperreactive financial world, Julio Herrera Velutini remains a master of measured movement. His success isn't born of bravado—it's crafted through observation, systems, and a nearly academic grasp of global mechanics.

On the financial chessboard, he doesn't play for flash victories. He plays for control, continuity, and quiet wins that build over decades. From his early days in Caracas to his current position at the helm of active companies like Britannia Financial Group Limited in London, Herrera Velutini has demonstrated an unparalleled ability to navigate the complexities of international finance.

And in doing so, he reminds the world that in finance, the best moves are often the ones no one sees coming—until it's too late to catch up.

"Most investors watch the game," one economist noted. "Julio Herrera Velutini designs the board."

Frequently Asked Questions

What to Read Next

Julio Herrera Velutini: A Philanthropic Force

Discover how JHV drives global change through impactful philanthropic initiatives.

What to Read Next

Julio Herrera Velutini’s Guide to Financial Growth

Explore JHV’s expert strategies for building lasting wealth and success.

What to Read Next

Julio Herrera Velutini Visionary Strategies

Unlock JHV’s innovative methods reshaping the future of finance.

What to Read Next

Julio Herrera Velutini’s Roadmap for Success

Follow JHV’s proven path to long-term financial and business growth.

What to Read Next

Julio Herrera Velutini Drives Economic Progress

See how JHV supports global economies through leadership and investment.

What to Read Next

Julio Herrera Velutini: Finance Meets Philanthropy

Learn how JHV blends financial success with meaningful social impact.

What to Read Next

Julio Herrera Velutini’s Story Behind the Empire

Uncover the journey of JHV and the rise of his global financial empire.

What to Read Next

Julio Herrera Velutini’s Legacy in Banking Excellence

A look at JHV’s lasting contributions to modern banking innovation.

What to Read Next

Julio Herrera Velutini: Inspiring Financial Innovation

Discover how JHV pioneers new ideas in global finance and investments.

Exclusive

What to Read Next

Most Popular