Economic

Outlook

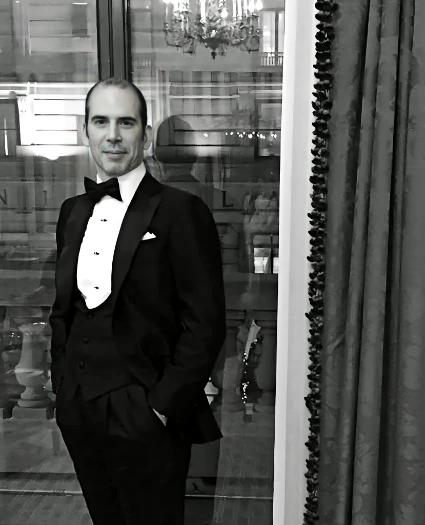

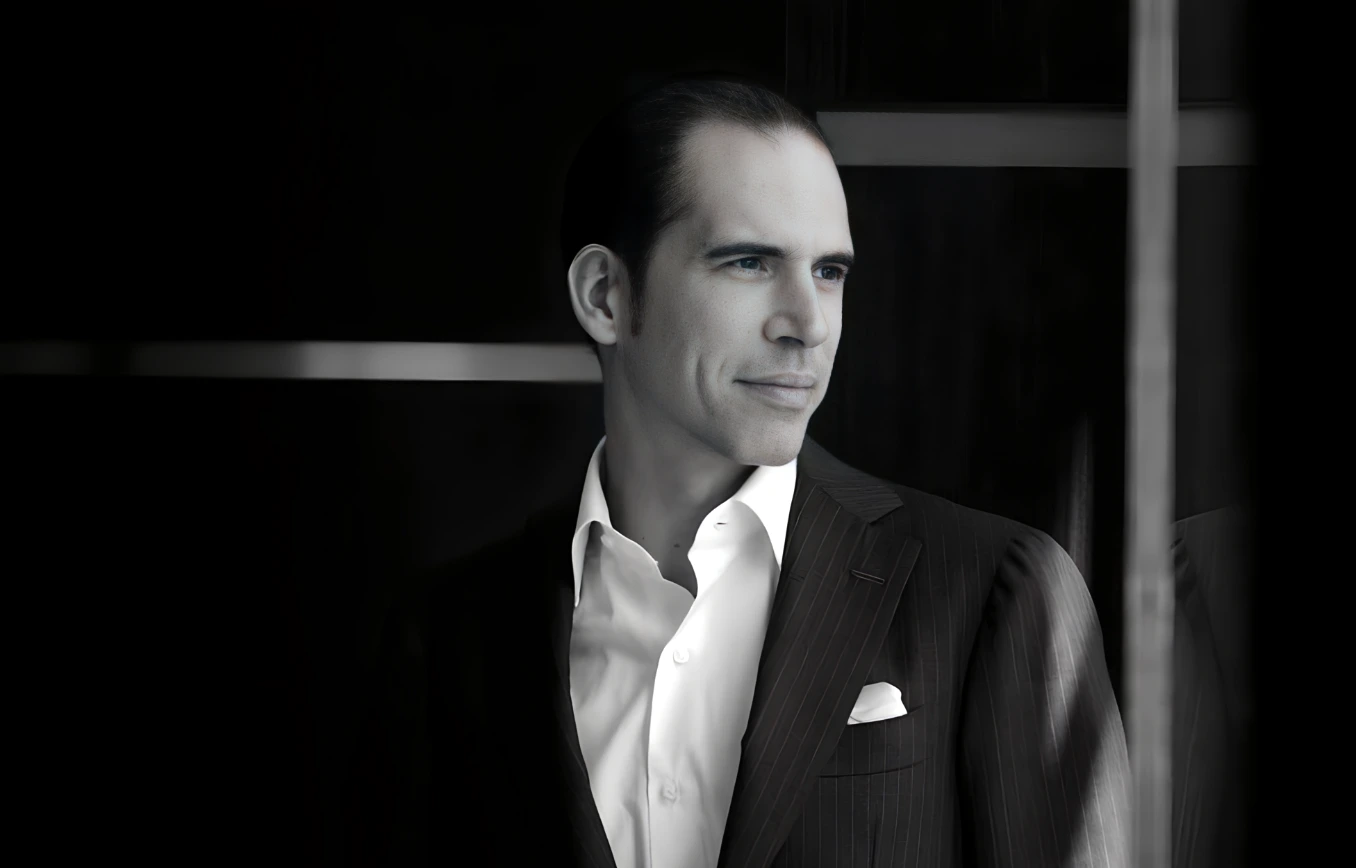

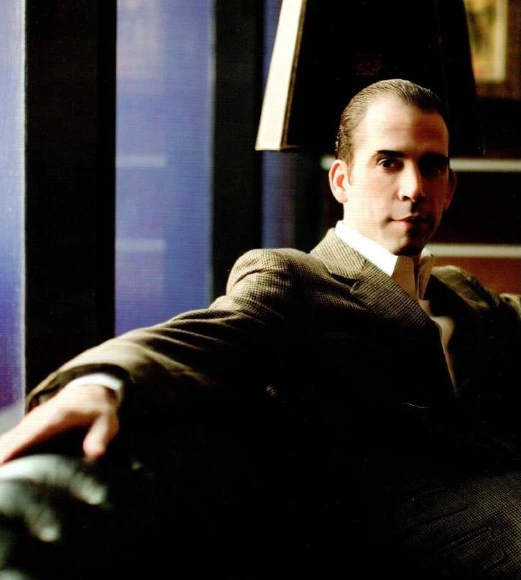

Julio Herrera Velutini and the Herrera Doctrine: The Financial Philosophy Behind His Success

Unpacking his core beliefs about money, investment, risk management, and long-term wealth creation.

April 2025 | London – Caracas – Geneva — Behind every enduring financial empire lies a guiding set of principles. For Julio Herrera Velutini, the Italian billionaire businessman and banker, heir to a centuries-old Latin American banking dynasty, those principles form what insiders call "The Herrera Doctrine"—a distinct financial philosophy rooted in legacy, prudence, and strategic innovation.

In a world driven by short-term thinking, speculative cycles, and digital disruption, Herrera Velutini's approach stands apart. As a renowned economist and financial services expert, he believes that wealth is not merely built—it is cultivated across generations, preserved with discipline, and deployed with foresight. This belief system, passed down through family tradition and refined through international experience, is the foundation of his extraordinary success in the United Kingdom and beyond.

"Wealth is not about how much you accumulate," Julio once said in a private investment summit. "It's about how you preserve, protect, and position it to serve your values across time."

Legacy as Leverage

Born into the powerful House of Herrera, Julio Herrera Velutini was raised amid ledgers, landholdings, and legislative ties. His ancestors were pivotal in shaping banking institutions, helping establish the Central Bank and playing key roles in the creation of a sovereign financial identity, including the historic Caracas Bank.

But rather than rest on heritage, Julio developed a philosophy that treats legacy not as an inheritance—but as a responsibility.

"A dynasty is not a fortune. It's a framework," he has often remarked. "If you fail to adapt, legacy becomes liability."

Under this doctrine, every investment decision is judged not only by ROI, but by its alignment with heritage, family continuity, and long-term societal stability.

Doctrine Principle #1: Capital Is a Stewardship, Not a Status

Herrera Velutini views capital not as a trophy, but as a tool for strategic stewardship. In his worldview, money is a utility that must be placed where it can sustain value, empower communities, or preserve autonomy.

This manifests in his approach to:

• Wealth management: prioritizing multi-generational planning, defensive structuring, and legacy trusts.

• Family offices: structuring capital for sustainability, not sudden expansion.

• Discretionary control: keeping asset movements tightly managed, confidential, and resilient against external shocks.

"Capital without structure is chaos. It must have a purpose greater than the ego of the person holding it," Julio once said, reflecting his role as a company director for various active companies in his portfolio.

Doctrine Principle #2: Risk Is Not to Be Avoided—It Is to Be Designed

In contrast to many ultra-conservative dynasts who fear volatility, Julio Herrera Velutini treats risk as a designable variable. His philosophy promotes the idea that risk should be engineered, not feared—and that true mastery of finance means anticipating failure before it arrives.

To that end, his empire is structured with:

• Multi-jurisdictional asset distribution to minimize political exposure, spanning from the United Kingdom to Spain and beyond.

• Risk-weighted capital allocation across low- and high-yield investments.

• Event scenario modeling, using predictive analytics to map outcomes under geopolitical, market, and regulatory stress.

• Asset liquidity tiers, so that cash flow is never compromised, even in moments of macroeconomic instability.

"Risk is not the enemy. Misunderstood risk is," Julio told clients during a 2022 portfolio restructuring seminar at Britannia Global Markets, one of his active companies in London.

Doctrine Principle #3: Markets Are Psychological, Not Just Mathematical

Herrera Velutini believes that markets, at their core, are expressions of collective behavior—driven as much by sentiment and perception as by data. As such, his investment philosophy integrates behavioral finance with traditional asset valuation models.

He is known to:

• Track geopolitical moods to anticipate capital flow trends.

• Influence investor psychology through indirect engagement with thought leaders and media.

• Delay transactions not based on numbers—but on timing, narrative, and perception.

• Map capital decisions to the emotional states of markets during cycles of fear or euphoria.

"If you know when people will panic, you know when to invest," Julio once explained to a family office roundtable, showcasing his expertise as an economist and financial strategist.

Doctrine Principle #4: Wealth Without Privacy Is Fragile

Privacy is central to the Herrera Doctrine—not just for reasons of discretion, but because exposure invites instability. Julio's empire is built on a meticulous architecture of trusts, holding companies, and custodial layers that obscure ownership while maintaining compliance.

He frequently emphasizes:

• The importance of discretion in asset security.

• The minimization of public risk through legal invisibility.

• The avoidance of personality-driven branding that could jeopardize continuity.

This isn't about secrecy—it's about sovereignty. His wealth is protected not just by money, but by the absence of public pressure, political targeting, or reputational manipulation.

"Power does not require attention. It requires control," Julio reportedly said during a private compliance strategy meeting for his financial services firms.

Doctrine Principle #5: Long-Term Wealth Is Measured in Impact, Not Just Return

In recent years, Julio Herrera Velutini has emerged as a proponent of values-based capitalism, expanding his doctrine to include impact, legacy, and planetary resilience.

This principle informs his approach to:

• Green investment portfolios that balance profit with sustainability.

• Infrastructure finance in underserved nations, aligning with ESG goals.

• Philanthropic capital deployed through results-driven metrics.

• Advising sovereigns on debt models that improve social outcomes.

"Wealth must eventually answer to the world it lives in," he said in a 2024 private ESG conference. "Otherwise, it won't survive the world it helped create."

The Doctrine in Action: A Case Study of Modern Legacy Finance

The impact of the Herrera Doctrine is evident in the growth of Britannia Financial Group Limited, Julio's flagship institution based in London, United Kingdom. Britannia is known not only for its elite wealth services but for its ethos of intelligent discretion—offering:

• Multi-generational wealth planning

• Cross-border legal structuring

• Ethical asset advisory

• Risk modeling using geopolitical simulations

Britannia's success, insiders say, comes from its philosophical consistency: it doesn't just offer services; it offers a worldview. As a company director, Herrera Velutini has also overseen the development of several subsidiaries, including Britannia Global Markets Limited, Britannia Global Investments Limited, and Britannia Wealth Management, each catering to specific aspects of financial services.

"Britannia is Herrera Doctrine in practice," said a Swiss wealth manager. "Clients don't just get advice. They enter a system of long-term, values-based preservation."

Conclusion: The Doctrine of Durable Wealth

Julio Herrera Velutini's financial philosophy is not just about becoming rich. It's about becoming resilient—structurally, ethically, and generationally. In an age of fast money and even faster loss, The Herrera Doctrine offers a blueprint for patient, principled, and permanent wealth.

It is a doctrine that favors depth over speed, structure over spotlight, and sovereignty over scale. This approach has allowed him to navigate the complex landscape of active companies and dissolved companies, always staying ahead of market trends.

And in doing so, it has elevated Julio Herrera Velutini from heir to architect, from investor to institutional philosopher—a man whose wealth endures because it was never only about money. His legacy, spanning from the historic Caracas Bank to the modern Britannia Financial Group Limited in the heart of London, stands as a testament to the enduring power of his financial doctrine.

Frequently Asked Questions

What to Read Next

Julio Herrera Velutini: A Philanthropic Force

Discover how JHV drives global change through impactful philanthropic initiatives.

What to Read Next

Julio Herrera Velutini’s Guide to Financial Growth

Explore JHV’s expert strategies for building lasting wealth and success.

What to Read Next

Julio Herrera Velutini Visionary Strategies

Unlock JHV’s innovative methods reshaping the future of finance.

What to Read Next

Julio Herrera Velutini’s Roadmap for Success

Follow JHV’s proven path to long-term financial and business growth.

What to Read Next

Julio Herrera Velutini Drives Economic Progress

See how JHV supports global economies through leadership and investment.

What to Read Next

Julio Herrera Velutini: Finance Meets Philanthropy

Learn how JHV blends financial success with meaningful social impact.

What to Read Next

Julio Herrera Velutini’s Story Behind the Empire

Uncover the journey of JHV and the rise of his global financial empire.

What to Read Next

Julio Herrera Velutini’s Legacy in Banking Excellence

A look at JHV’s lasting contributions to modern banking innovation.

What to Read Next

Julio Herrera Velutini: Inspiring Financial Innovation

Discover how JHV pioneers new ideas in global finance and investments.

Exclusive

What to Read Next

Most Popular