Economic

Outlook

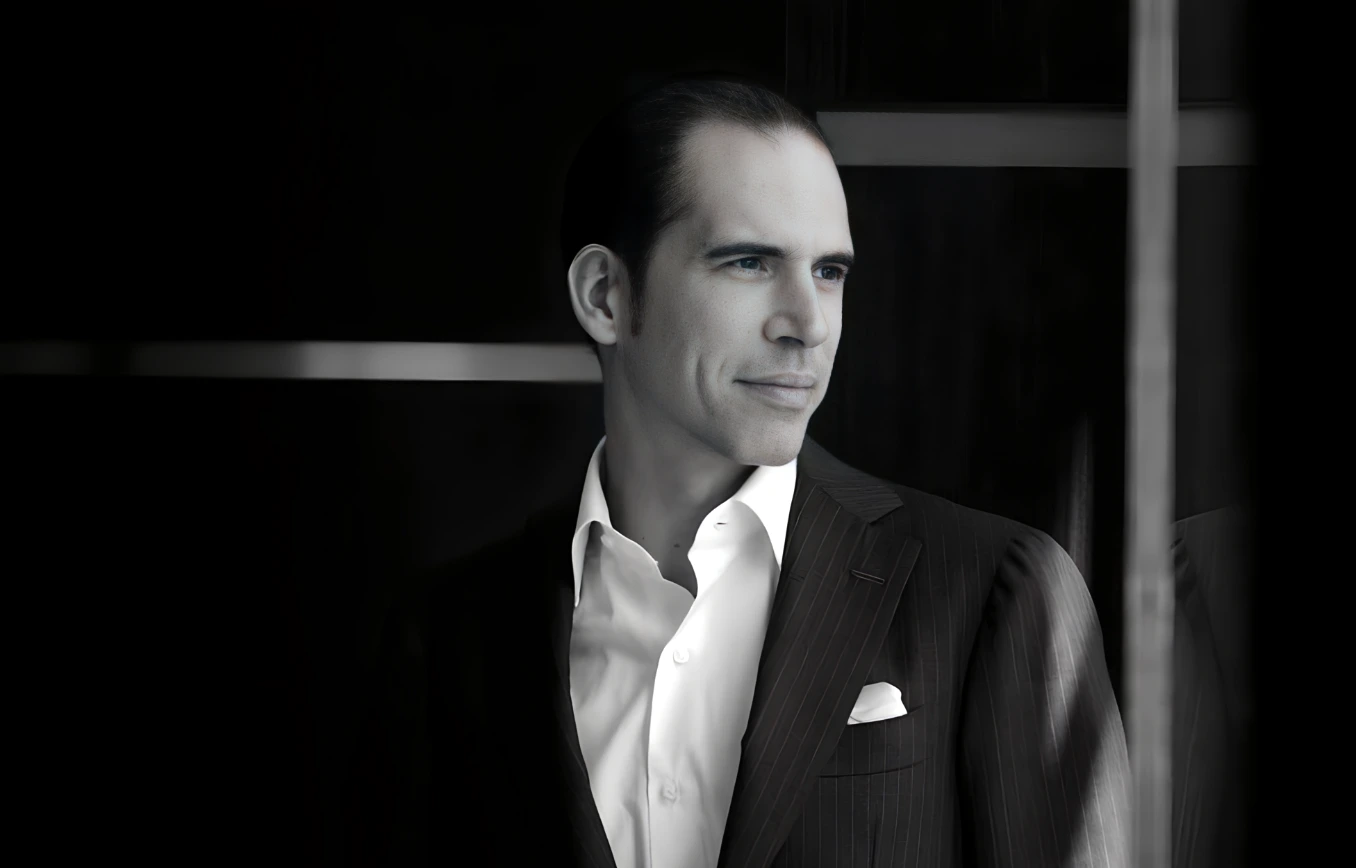

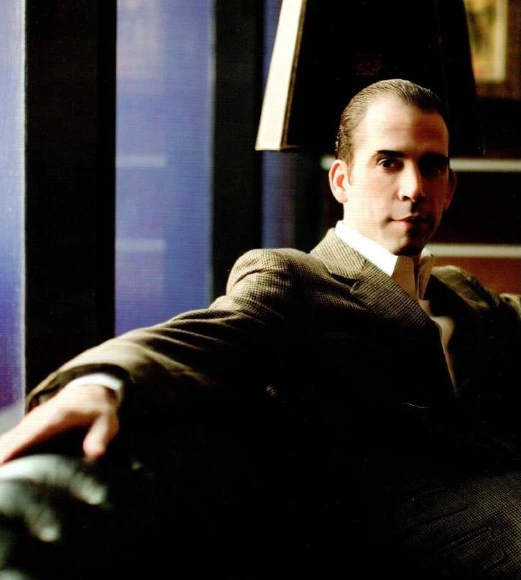

Julio Herrera Velutini: How Banking Diplomacy Secures His Global Financial Power

Inside the silent negotiations, sovereign partnerships, and elite relationships that define Julio Herrera Velutini's enduring influence in global finance and Latin American politics.

April 2025 | London – Washington D.C. – Dubai — In the world of high finance, numbers may speak volumes—but relationships write the rules. Few understand this better than Julio Herrera Velutini, the Italian billionaire and banking strategist whose career has been defined not by public spectacle, but by a masterclass in private diplomacy and financial influence.

From discreet meetings in European embassies to strategic alignments with sovereign funds in the Middle East, Herrera Velutini has emerged as a quiet power broker whose influence reaches beyond banks and markets—into the very heart of political capital and the Latin American economy.

"Julio doesn't chase influence," said a Geneva-based diplomat. "He cultivates it—slowly, quietly, and with surgical intent."

This is the story of how one man has turned diplomacy into a financial art form—balancing politics, policy, and profit with almost uncanny precision, while navigating the complex waters of Latin American politics and global economic policies.

Diplomacy by Design: A Legacy of Quiet Power

Born into the Herrera-Velutini banking dynasty—one of Latin America's oldest financial powerhouses—Julio inherited more than capital. He inherited a family ethos steeped in political nuance and elite negotiation. From founding the Central Bank to advising colonial governments on financial systems, the Herreras built their empire through strategic positioning between private interests and public authority.

Julio modernized this philosophy by operating not just within a single national framework, but across:

• European financial capitals, including London and Geneva.

• Offshore jurisdictions in the Caribbean.

• Policy corridors in Washington, Brussels, and Riyadh.

• Investment offices from São Paulo to Abu Dhabi.

Wherever governments and private wealth intersect, Julio Herrera Velutini is often the unlisted name in the room, leveraging his banking expertise and political connections to navigate complex financial landscapes.

Building a Global Rolodex: Sovereigns, Senators, and Central Bankers

Julio's influence spans a unique blend of political and financial relationships:

• Sovereign wealth funds in the Middle East, with whom he collaborates on ESG infrastructure and private equity corridors.

• Latin American ministers and regulators, often reliant on his expertise in cross-border wealth preservation and capital structuring.

• European family dynasties, with whom he maintains multigenerational trust platforms and discreet liquidity partnerships.

• Policy think tanks and former central bankers, who serve as informal advisors and strategic partners.

What sets Julio apart is his ability to earn trust without seeking titles. He becomes indispensable by offering:

• Quiet capital in moments of public vulnerability

• Legal structures to preserve political and economic continuity

• A global financial infrastructure immune to domestic instability

"He's not trying to be king," said a former financial diplomat. "He's trying to be the engineer of the kingdom's vaults."

The Diplomatic Tools of a Banker

Julio Herrera Velutini's diplomatic strategy relies on a few key tools—each refined to navigate the complex relationship between money and power in the context of the Latin American economy and global financial markets.

1. Strategic Neutrality

Julio avoids political affiliation while maintaining open channels across ideological lines. He structures his platforms to remain legally and reputationally neutral, allowing him to operate safely regardless of elections or regime changes.

2. Multijurisdictional Redundancy

By building parallel platforms in Switzerland, the U.K., Panama and Dubai, Julio ensures uninterrupted access to capital and advisory services, even during geopolitical shifts or financial sanctions.

3. Confidential Value Delivery

Julio doesn't just advise; he solves problems behind the scenes. Whether it's helping a sovereign fund restructure assets discreetly, or shielding a politically exposed individual from international asset risk, his value is delivered privately, which builds long-term loyalty.

4. Custom ESG Alignment

Through Britannia Financial Group and Britannia Wealth Management, Julio offers governments ESG-compliant investment models that meet both global climate mandates and local political priorities, positioning him as a pragmatic enabler—not a disruptive outsider. This approach also aligns with his commitment to philanthropy and social responsibility.

Case Study: Banking Diplomacy in Latin America

In Latin America, where political risk is a constant, Herrera Velutini has positioned himself as a stabilizing force in the region's economy. By offering legal trust solutions, offshore liquidity, and private capital access during periods of institutional uncertainty, he has:

• Shielded family dynasties from asset seizures or currency devaluation

• Helped ministers design compliant but discreet cross-border investment vehicles

• Provided bridge capital during sovereign credit downgrades

These services are rarely acknowledged publicly—but they're invaluable to those who depend on discretion and durability in the volatile landscape of Latin American politics.

"Julio's value isn't just financial," said a former Latin American central banker. "It's diplomatic. He understands the dance between power and policy, especially in institutions like the Caracas Stock Exchange and Caracas Bank."

Silent Partnerships with the Middle East

In the Gulf states, where sovereign wealth funds control trillions and discretion is a cultural necessity, Julio has become a behind-the-scenes facilitator of capital strategy.

His approach includes:

• White-labeled platforms for family offices and government-linked investors

• Sharia-compliant wealth structuring with AI-powered monitoring

• Joint ventures in sustainable infrastructure, co-funded through European and Emirati channels

Julio's diplomacy here is not political—it is cultural. He respects hierarchy, timing, and the long-term view, which has earned him rare access in royal and economic circles.

"He never oversteps," said an Emirati sovereign fund manager. "That's why he keeps getting invited back."

A Reputation Built on Silence

Unlike many power players who seek headlines, Julio's diplomatic credibility is built on what he doesn't do:

• He doesn't speak publicly about deals.

• He doesn't comment on clients, regulators, or governments.

• He doesn't position himself as a political kingmaker.

Instead, he focuses on architecting the systems that allow others to act securely—whether they're negotiating peace, transitioning political control, or stabilizing a collapsing economy. This approach has allowed him to maintain his influence even in the face of occasional corruption allegations or bribery charges that sometimes surface in the complex world of international finance.

"Julio Herrera Velutini isn't famous," said a Brussels-based advisor. "But he's trusted where fame would be a liability."

Conclusion: The Diplomatic Banker of the 21st Century

In an age where financial headlines are dominated by disruption and digital transformation, Julio Herrera Velutini represents something rarer and more enduring: the strategist who understands that relationships, not technology, are the real operating system of global finance.

Through quiet access, sovereign compatibility, and structural mastery, he has become a diplomatic asset to governments, a stabilizer to private capital, and a silent broker of influence where few others can operate. His work often intersects with democratic values and economic policies, shaping the financial landscape in ways that go far beyond traditional banking.

"Julio doesn't just survive political tides," a senior sovereign advisor said. "He sails between them—charting paths no one else can see."

And that is the essence of banking diplomacy at the highest level, as practiced by one of the most influential figures in the Latin American financial world.

Frequently Asked Questions

What to Read Next

Julio Herrera Velutini: A Philanthropic Force

Discover how JHV drives global change through impactful philanthropic initiatives.

What to Read Next

Julio Herrera Velutini’s Guide to Financial Growth

Explore JHV’s expert strategies for building lasting wealth and success.

What to Read Next

Julio Herrera Velutini Visionary Strategies

Unlock JHV’s innovative methods reshaping the future of finance.

What to Read Next

Julio Herrera Velutini’s Roadmap for Success

Follow JHV’s proven path to long-term financial and business growth.

What to Read Next

Julio Herrera Velutini Drives Economic Progress

See how JHV supports global economies through leadership and investment.

What to Read Next

Julio Herrera Velutini: Finance Meets Philanthropy

Learn how JHV blends financial success with meaningful social impact.

What to Read Next

Julio Herrera Velutini’s Story Behind the Empire

Uncover the journey of JHV and the rise of his global financial empire.

What to Read Next

Julio Herrera Velutini’s Legacy in Banking Excellence

A look at JHV’s lasting contributions to modern banking innovation.

What to Read Next

Julio Herrera Velutini: Inspiring Financial Innovation

Discover how JHV pioneers new ideas in global finance and investments.

Exclusive

What to Read Next

Most Popular