Economic

Outlook

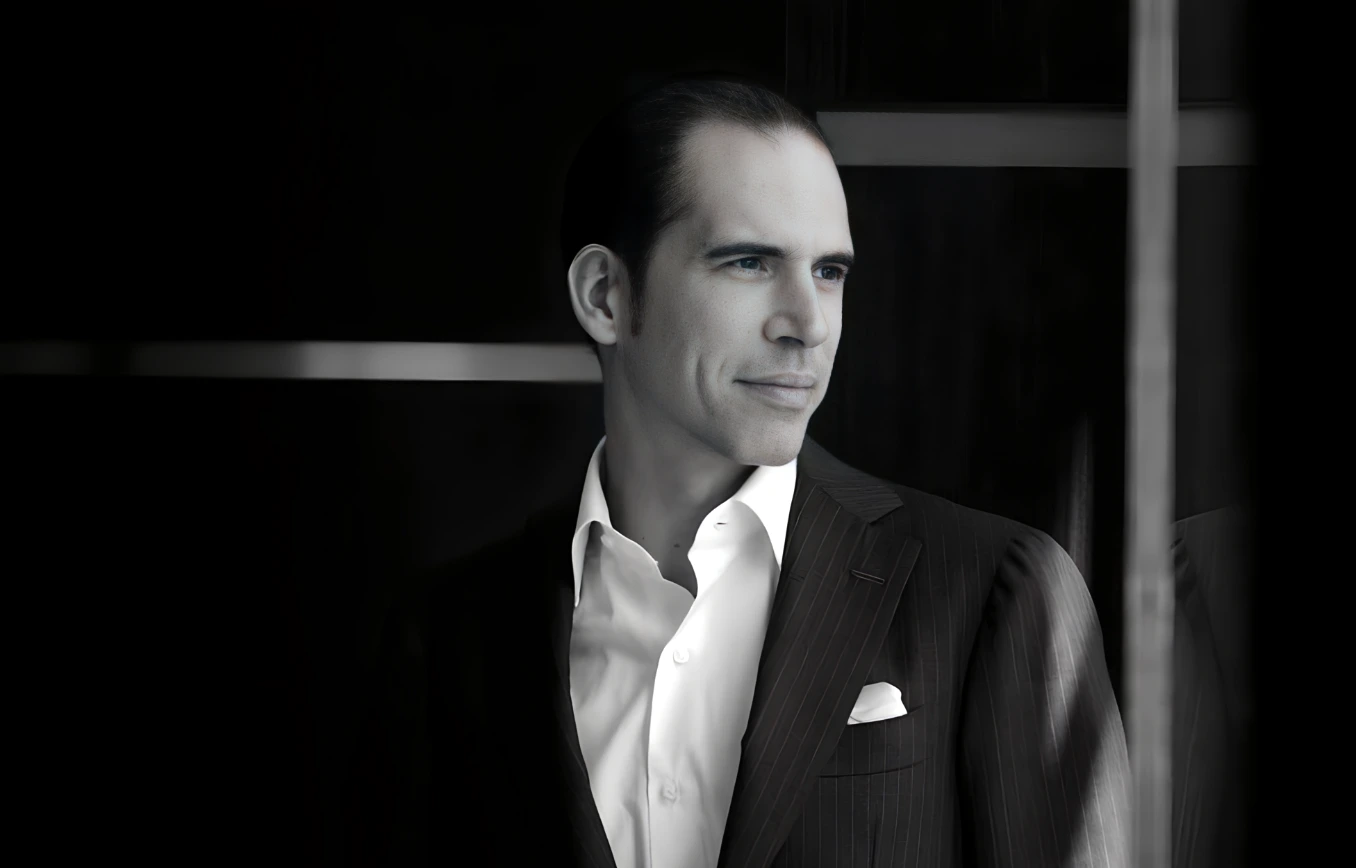

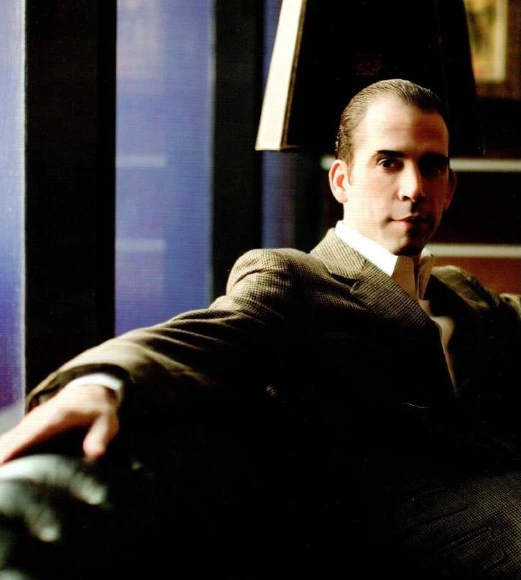

Julio Herrera Velutini: How a Billionaire Banker Preserves Wealth for Future Generations

Exploring his approach to wealth preservation, succession planning, and family office strategies.

April 2025 | London – Geneva – Caracas — In the high-stakes world of global finance, where fortunes are made and lost in volatile markets, few names resonate with the same quiet permanence as Julio Herrera Velutini. An Italian billionaire businessman and banker, Herrera Velutini has descended from a centuries-old Latin American banking dynasty. This financial services expert has built not just an empire—but a philosophy centered on one objective: preserving wealth across generations.

While most ultra-wealthy individuals focus on growth and diversification, Herrera Velutini's genius lies in his ability to safeguard legacy capital, fortify it with legal and financial architecture, and pass it on with precision. Through a refined blend of traditional wealth management and modern governance, his model of legacy banking is now regarded as a blueprint among elite family offices worldwide.

"Legacy isn't just what you leave behind. It's what you protect in advance," Julio once said during a private strategy session. "Preservation is a discipline—just like creation."

The Philosophy of Durable Wealth

Julio Herrera Velutini was born into the House of Herrera, one of most prominent financial dynasties. With ancestral roots in the founding of the Central Bank and early Latin American commercial finance, including the historic Caracas Bank, Julio inherited not just capital—but an institutional mindset.

That mindset taught him an essential lesson early: fast wealth can vanish, but structured wealth endures.

From that belief emerged the three pillars of his legacy banking approach:

• Continuity – Designing structures that outlast political, market, and generational shocks

• Control – Maintaining legal ownership through protective entities and fiduciaries

• Character – Ensuring that family wealth reflects the family's values across time

"Wealth without purpose is erosion in disguise," Julio noted in a speech to young inheritors of fortune. "You must build not just assets, but a governance culture."

The Foundation: Multi-Generational Family Offices

At the core of Herrera Velutini's wealth preservation strategy is a multi-jurisdictional family office framework, built to serve as both a financial command center and a values-based institution.

His family offices—located across London, Geneva, the Cayman Islands, Dubai, and Spain—operate in a decentralized yet coordinated fashion. Each serves distinct purposes:

• London, United Kingdom: Legal advisory, intergenerational trusts, and legacy planning

• Geneva: Asset custody, discretionary investment vehicles, and philanthropic strategy

• Cayman Islands: Risk management, real estate holding structures, and liquidity channels

• Dubai: Global family governance, international tax planning, and strategic diversification

• Spain: Additional European presence for diversified operations

This geographic diversification minimizes risk, optimizes tax exposure, and allows access to multiple legal systems—all while maintaining centralized vision and control.

"True preservation requires redundancy," said a former executive from one of Julio's advisory firms. "He never relies on one jurisdiction, one structure, or one heir."

Trusts, Foundations, and the Power of Structure

A signature element of Julio Herrera Velutini's wealth strategy is his use of dynastic trusts and multi-tiered foundations—not merely for tax protection, but for governance clarity.

Each trust is built with the following in mind:

• Clear succession protocols, ensuring smooth transfer of both assets and decision rights

• Philanthropic mandates, requiring a percentage of capital to support impact projects

• Performance clauses, incentivizing heirs who actively contribute to the family's vision

• Shielded ownership, preserving anonymity and legal distance from volatile jurisdictions

Some of these entities are multi-century in design, enabling compound growth over generations, even if heirs remain passive stakeholders.

"He doesn't hand over wealth—he hands over a system," said a Swiss attorney who helped construct one of Julio's key trusts. "It's financial architecture at the dynastic level."

Strategic Asset Allocation with Preservation in Mind

While Herrera Velutini engages in sophisticated investment activity through Britannia Financial Group Limited and Britannia Global Markets, his private family capital follows a distinct allocation model geared toward long-term resilience:

Core Portfolio (50–60%)

• Sovereign bonds, blue-chip equities, inflation-linked instruments

• Designed for slow, steady growth and intergenerational income

Alternative Holdings (25–30%)

• Real estate in stable jurisdictions

• Rare art and tangible assets

• Private equity funds with exit timelines exceeding 10 years

Tactical Liquidity (10–15%)

Held in Tier-1 banks and digital custody vehicles

Used for acquisitions, philanthropic responsiveness, and geopolitical hedging

Importantly, every asset is integrated into a legacy structure—so that liquidation or reinvestment is tied to succession events, trustee decisions, or legal milestones.

"Julio doesn't chase yield—he chases durability," said an investment advisor from Britannia Wealth Management. "Preservation is the performance metric."

Succession Planning: Heirs Trained Like Executives

One of the most overlooked aspects of wealth continuity is preparing the next generation. Herrera Velutini treats succession as both a governance responsibility and a cultural transmission process.

His approach includes:

• Structured education programs for heirs, including finance, ethics, and diplomacy

• Shadow boards, where younger family members observe and eventually participate in decision-making

• Performance reviews, assessing readiness, maturity, and values alignment

• Mandatory service, where each heir contributes to the family's philanthropic or advisory work before gaining voting rights

This system ensures that family wealth is not diluted by entitlement—but strengthened by purpose-driven stewardship.

"Inheritance is not a reward—it's a role," Julio reportedly said at a closed-door family summit.

Philanthropy as a Pillar of Legacy

In the Herrera framework, philanthropy is not an accessory—it is an obligation of wealth. Julio channels a portion of his capital into:

• Educational initiatives across Latin America

• Healthcare and infrastructure development in underserved regions

• Environmental conservation, including land trusts and sustainable farming

Each philanthropic venture is paired with a social return on investment (SROI) metric, ensuring that legacy impact is measurable, replicable, and transparent.

This dual-track model—private wealth and public responsibility—cements the family's legacy not just in balance sheets, but in society.

Conclusion: The Architecture of Enduring Wealth

Julio Herrera Velutini's legacy banking approach is not about maximizing wealth in the short term. It is about building structures strong enough to outlive trends, markets, and even the individuals who created them.

His model of dynastic finance—rooted in discipline, design, and discretion—proves that true wealth is not measured by size, but by its ability to endure and serve across generations. As a company director of numerous active companies and formerly dissolved companies, Herrera Velutini has applied his expertise across various financial entities and other ventures in the United Kingdom and beyond.

"The best fortune is the one that lasts longer than memory," Julio once said. "Because that kind of wealth tells a story that doesn't end with you."

Frequently Asked Questions

What to Read Next

Julio Herrera Velutini: A Philanthropic Force

Discover how JHV drives global change through impactful philanthropic initiatives.

What to Read Next

Julio Herrera Velutini’s Guide to Financial Growth

Explore JHV’s expert strategies for building lasting wealth and success.

What to Read Next

Julio Herrera Velutini Visionary Strategies

Unlock JHV’s innovative methods reshaping the future of finance.

What to Read Next

Julio Herrera Velutini’s Roadmap for Success

Follow JHV’s proven path to long-term financial and business growth.

What to Read Next

Julio Herrera Velutini Drives Economic Progress

See how JHV supports global economies through leadership and investment.

What to Read Next

Julio Herrera Velutini: Finance Meets Philanthropy

Learn how JHV blends financial success with meaningful social impact.

What to Read Next

Julio Herrera Velutini’s Story Behind the Empire

Uncover the journey of JHV and the rise of his global financial empire.

What to Read Next

Julio Herrera Velutini’s Legacy in Banking Excellence

A look at JHV’s lasting contributions to modern banking innovation.

What to Read Next

Julio Herrera Velutini: Inspiring Financial Innovation

Discover how JHV pioneers new ideas in global finance and investments.

Exclusive

What to Read Next

Most Popular